Practicing patients today and time to review history...

Looking over my two back to back days trading CERU, theres a very clear difference in the two trades. One LOSER and one WINNER.

What the difference?? PATIENTS.... NOT getting excited to make a trade and being ok that you might miss this. Paying attention to key levels, past areas of support & resistance.

On Tuesday I bought when CERU was 70% up on the day at 2.60 and near previous resistance levels from June 2016. Which where 2.60-2.63...

Didn't even notice those resistance levels till I studied the history of this chart for 3 hours after working a 13 hour day waiting tables. Didn't even pay attention to the fact its up 70%.

Had I taken the time to make this trade with a solid plan, knowing the key levels, and history, I would never have traded and still have have the 75$ I lost.

Today was much different. Much more planned and prepared.

There are a few reasons why this was my main interest today...The PM Volume, its chart history, It was trading near its previous day high.

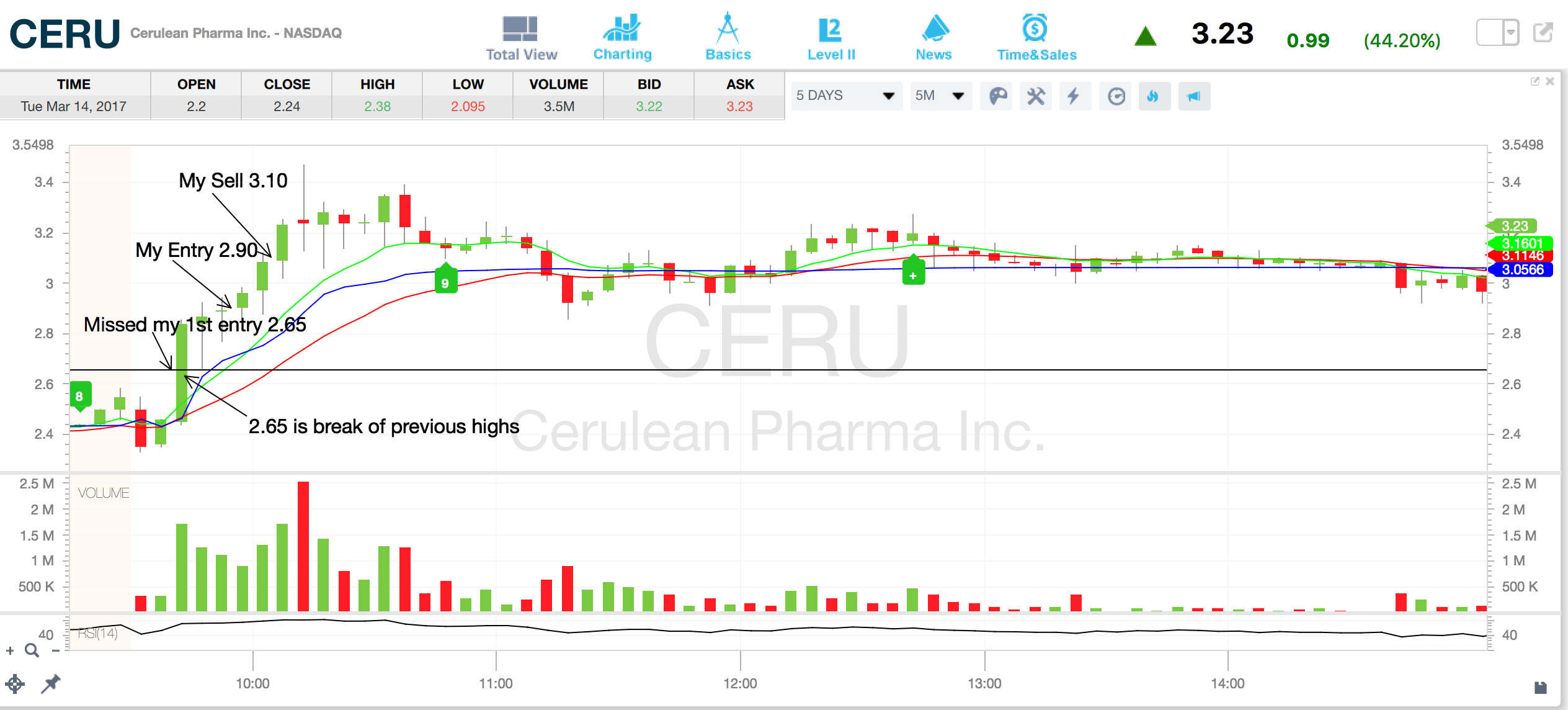

My first plan to enter was on that break of 2.62. I wanted in at 2.61 but it went without me very quickly.

I bought in at 2.90 when the 2 minute candle traded higher than the previous. My order was filled. The lowest the stock went after that was 2.82. Which had made me little nervous but this time I had a solid plan. Stop is set at 2.79. No more than 1 minute later and its testing 3. I set my Limit order immediately at 3.10 and got filled just before a slight pull back and going to 3.45....

It was a solid play for me and much needed one. Winning a trade like this one, one that is planned and studied, proves to your self, you're on the right track!

Leave a comment below & Please give KARMA ❤️

Join now or log in to leave a comment