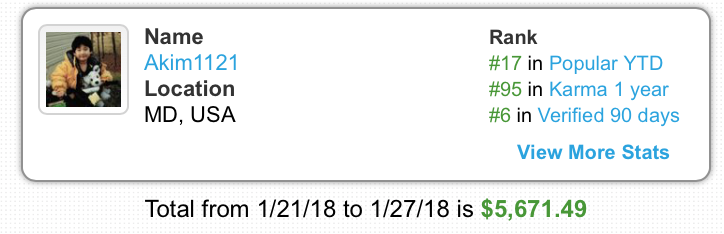

1. Week performance: +$5.7k

2. Just paid the monthly interest on all of my hard-to-borrow short positions -- ouch. Death by a thousand cuts. Reviewing the month's trades, my swing shorts aren't even that profitable. I just take them as an excuse to apply my chart reading skills and to feel less guilty about the easier and more profitable trades. Will cut these trades out completely, or at least in February.

3. My biggest losses (eg $GALT) have come from being too early, but patience has also been one of my greatest strengths, and why my win rate is so high -- about 80%. Though win rate in the end is meaningless. It's how much you make when you're right and how little you lose when you're wrong that counts. A major February goal to avoid big losses from being too early.

4. It goes without saying but I'll say it anyways because we all need constant reminding: don't over trade, don't over trade, don't over trade. I have five or six patterns I trade again and again but I will cut that number down to two or three in February. Experimenting and refining my strategy is over ... at least for now.

5. Will post a quick watchlist this Sunday.

-AK

oh man those patterns ... I would LOVE to know what those are :) <= big overly winning smile

how much does it cost you to hold HTB overnight? for me its x7 the first night then x1 every night after that. way to much for me

@aidan222sharpe it depends on the stock but most of the crypto/block chain related stocks had rates over 90 to 100% (eg $dpw, $kodk) ... and I was holding those for days. Never again. The fee is annualized over a year/nominal at first but once you start inc bet size, starts to measurably cut into profits.

Great post. What strategies are you playing right now? Sounds like you mostly shorting stocks.

Join now or log in to leave a comment