What would you do if you received an email in the morning from your broker entitled, "Your trading has been restricted"? Especially after you've had a fantastic run of successful trades like my run from 11/23 to 11/30 where I made about $12,000 in profits? And after you are primed for another positive day, having prepped for a few hours before market open? Would you think "they" are trying to keep you down? Take away your seat at the market table? Not letting you use your capital?

If that would be your first response, then I recommend doing what I did today: take a breath, understand what happened, and adapt. The answer to all three questions above is "no".

This morning I received a notice of a 90 day trading restriction 26 minutes before the market opened. Although disappointed, I had a sense of what was up while I was prepping when I checked my balances.

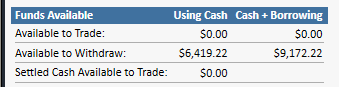

What one should expect to see are values in the "Available to Trade" line and the "Settled Cash Available to Trade" line. When I tried to set a buy order for after the market opened on a stock I was watching, I was given an error that there were no funds in my account to place the order.

Contrast that to yesterday, when I traded two stocks (and one multiple times), I was looking only at the "Available to Trade" line as I was doing so and ignoring the fact that the other line was zero. You see, I'd place a trade and the first line would go down, then exit the trade and the first line would go up plus my profit from the trade. But the "Settled Cash" line would not be adjusted because of the SEC rule which requires T+2 days before one's trades are truly completed, with all the accounting adjustments made in one's account. So, by engaging in multiple trades yesterday without having settled funds from the trades in days prior, I was essentially using funds which, although mine in the future, were not mine at the time. Meaning, I was borrowing on unsettled funds to enact my trades and that's not ok with the broker or the SEC.

What's the reasoning? It is for protection of the trader and the broker, really. What if, instead of making gains I was taking losses? Then by taking a trade without settled funds, I'd really be borrowing from my broker without the right to do so and trying, unintentionally or not, to pass those losses onto them. See these links:

https://www.fidelity.com/learning-center/trading-investing/trading/avoiding-cash-trading-violations

How does one adapt to this? Essentially, only trade based off of one's settled cash amount plus margin amount if one is allowed to use margin (note that for OTCs some brokers won't allow for the use of margin). Build up one's funds so that, if following a strategy of multiple trades in a day, the total value of those trades does not go over the settled amount. Also, if one is going to trade one's full settled amount, then plan to sit out from trading for a few days until the funds settle again. Even for accounts with funds above the PDT rule T+2 is in effect. So unless one trades only a portion of their funds each day, the number of days available to trade remains similar to having an account less that $25,000.

On the plus side, my restriction is only for 90 days temporarily. As long as I trade with only settled funds during that period, then the restriction will lift. But if I keep violating this rule, then my broker will make the restriction permanent. To me, this is all the more reason to trade well when I do trade and build up my account as fast as I can so that I can take advantage of the opportunities which are being presented every day.

Moral: Smart ninjas keep to the shadows and trade without getting the attention of one's broker or the market. Unnoticed ninjas are more successful ninjas.

[Update 12/3]

Allow me to be more specific on the tactics required. When you look at the profit charts of profit.ly members who are doing really well, you generally see a similar pattern. Several years of choppy motion until at some point (let's say around the $100,000 level) and the chart switches to a new, often parabolic, curve. Why is that? Is it solely because the member's trading finally settles down and they just all get consistent? I think that is definitely a factor. But one can't ignore that available capital is also a large factor here.

Consider my trade on 11/27 (https://profit.ly/1N1plo) versus my trade on 12/3 (https://profit.ly/1N1uHA). The 11/27 trade was done in six rounds. The 12/3 trade was done in one round. The profit for the 11/27 trade was about $1,000 more, but the amount risked was higher for the 11/27 trade yet the profit percentage was higher for the 12/3 trade. So which was the better trade overall? Clearly the 12/3 trade. But also, which trade is easier to do with a small account? The 12/3 trade again.

Here's how. By taking the 11/27 trade in six rounds in one day, without taking the time for the funds to settle under the T+2 rule, the total amount of funds I put into the trade was $51,405.62. The actual amount I had for any round of the trades I took, however, was around $5,000. So... obviously that's why my hand was slapped by the broker. On the 12/3 trade, I took that as an overnight and put only $5,445.91 into it. The 12/3 trade was well within my settled cash amount and I made a better trade overall with it. If my amount of shares on 12/3 were as high as the total shares of the 11/27 trades (80k versus 600k), then I would have made much more in total profits for the 12/3 trade. But the way I traded it was markedly different from 11/27.

So these are the two keys to success I'm coming away with: available, settled cash on the one hand and good trades on the other hand. I know that I can make a few hundred to a few thousand dollars every day trading small moves like in the 11/27 trade. But to do that requires a much higher pot of available funds. I would need at least 3x the amount I put in if I were to do the same strategy. Meaning I would need a trading account of about $150,000 which remained mostly in cash each day. But if I were able to make more good trades rather than relying on small, repeated moves, I may be able to make near that amount with my small account. But the second strategy requires a lot more patience and recognition of patterns across a full trading day or across several days than the first strategy requires (and that relies mostly on recognizing turns of the tape).

Do you see my point? Most of us are starting out with small accounts. In order to make those work, it will require more of the trader at the beginning until they build up the capital to be able to take multiple, smaller trades in one day. The hope is that the skill one develops when building one's account will only get stronger as the capital reaches that tipping point and then one can see those much higher profits like we see with those verified traders who net over $100k. Therefore, don't get distracted when you study the trading strategies of those with larger accounts. At that level, they can afford to trade differently than those with smaller accounts can. But do practice the lessons of those who are being targeted with their trades, who don't emulate a trading bot, and can get a high profit percentage repeatedly. Those trades are worth mastering and maintaining throughout this journey.

Let me know what you think about this by leaving a comment.

Join now or log in to leave a comment