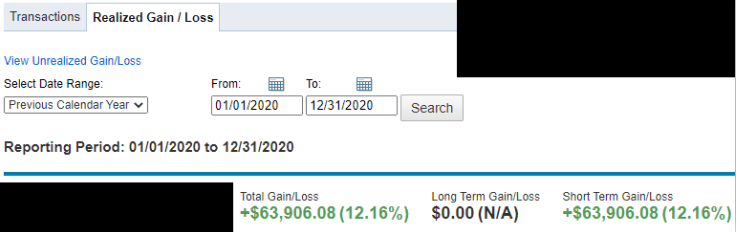

Allow me to recap my 2020 trading. Overall, this was my best year since I started trading largely due to the many opportunities in the market and the rest due to me narrowing down my approaches and working either a day trade dip buying pattern or a short-term swing pattern. My profit gains in 2020 were $63,906.08:

Although all of my completed trades ended with profit, that doesn't paint the full picture. I'd say the biggest challenges I have are chasing trades and not taking profit early enough, resulting in getting stuck for too long as I didn't want to take the loss. Let's break those down.

By chasing trades I mean having a stock on watch, with a limit buy order set at a potential dip point before market open, then that projected dip not happening as I thought, and then my getting impatient and raising my buy order higher and higher just to get in on the trade, rather than letting the trade come down to me. Usually, that resulted in the trade either not resulting in the total profit I was looking for, or the dip would actually happen later in the day and I'd often have that day trade turn into a swing trade.

By not taking profit early enough, I mean quite a number of situations where my overall thesis was sound, but the price action didn't get as high as I wanted on the long side and, rather than getting out with lower profit based on Level 2 data, hoping for some change and then watching the profit slip away and, again, my day trade turns into a swing trade.

The overall theme here is reluctance to act in the face of data and trying to make the market do what I want (which is impossible for one small retail trader) rather than just grabbing whatever I can.

This is why, btw, my profit winning percentage is so high. I'm above 90% there because my tendency has been to simply hold trades I didn't exit in time until they do provide profit. Because the market has been so volatile in the last year, and the majority of my trades were after the large market drop in the first third of the year, this has worked in my favor. But I'm very aware that this is a bad strategy and I could easily blow up my account by doing this. I'm currently in eight positions which, if I sold them all on Monday, would result in losses almost as high as my gains last year. So my main goal right now is to trade less while I focus on getting mostly in cash.

If that's my goal, then why don't I just cut those losses and start fresh, letting that become a great tax break? I considered it in December and ruled it out. I'm not willing to cut those losses as almost all of them are realistically able to see profit this year. Five positions are less than $0.01 away from break even or profit. One position is a major loss on a reverse split (down 95.65%) but the stock is slowly crawling up and I may get a little more before cutting it in Dec 2021. The other two, $AVCO and $GNUS, would both have to go up quite a bit for me to break even, but it seems they both have completed their bottoming phase and are starting to upswing, giving me a real chance of profit after mid-year.

Once I'm out of the majority of these positions, my planned strategy for 2021 is to stay mostly in cash, trading about 1/4th of my cash each day (to keep pace with the T+2 settlement date), and have almost all of my trades be day trades only. Although I think 2021 will be a bullish year, I'm expecting continued volatility such that I'd get more profit from multiple day trades than from swing trades. That worked really well for me several months ago but I got slapped with a trading restriction due to trading over my settled cash amount. Since I have a pattern of success doing those multiple dip buying trades on low priced stocks with high volume, I need to have my settled funds to be as large as possible so that I could take those trades.

As for the positive reflection of last year's trading, I had a major win with $MFA in June ($20,400), but the better story were all of the other trades I did after that where I collectively made 3x that amount. On quite a number of those trades I truly grabbed the meat of the move and cashed out on time. Those are the ones I'm looking to replicate. It is in those where I exemplified ninja trading the most with a study of the enemy, exploitation of weaknesses, and fast reflexes in getting in and out.

In 2021 I see myself getting more disciplined and achieving the $100k profit trading goal relatively quickly. Rinse and repeat will be the focus after that. I wish the same success for everyone else and I hope that the journey I detail here will benefit you.

Ganbatte!

Join now or log in to leave a comment