What My Statistics and My Trading Analysis has shown me

One thing that I have learned from being a trader is knowing your self. The best way to know your trading and what you have to improve in order to be consistently profitable, is keeping your trading journal and analyzing your statistics.

Profit.ly helps a lot in order to analyze your trades, but if you guys don’t want to pay and you want a really detailed analysis, you can always download your trades in a excel or numbers document, and start looking for patterns. It is a lot of work, but trust me it will be worth it.

What I put on each trade works for me and that is the following:

Date: Date I made the trade. This way is easy to find the trades made in a specific period

Ticker: Makes me analyze the stocks that I am better with. (Sector, Volatility, etc)

Entry: Entry Price

Exit: Exit Price

Size (# of shares in play) : To know how sensitive I am in relation to the stock price

$ Size (Money in play): Keeps me disciplined with my risk management

Profit: (Win or Lose): We all want this to be green right?

Why I entered in that “Entry“?: You will see things here like Dip Buying Panic (#5 Pattern on PennyStock Framework from Tim Sykes), Buying into consolidation on a strong stock, Buying breakout, Dip Buying on breakout level, Buying at V-WAP support once it broke intraday resistance, Scalp strong move, Dip buy at G/R level, Short bounce after panic on a strong stock, Overnight on a green stock that closes strong, Dip Buy Earnings Winner, and so on. Almost all of them are strategies learned from Tim Sykes.

Why I exited at that “Exit“?: Here you will find things like Taking profits, Cutting losses on a bounce, Cutting Losses Quickly, Selling into Strength, Selling on bounce, Top signal, Take profits after pullback, Out breakeven.

What did I learned from the trade?: This is my favorite. Every time I make a trade, either I learned something new, or I confirm something that I already know. You will find things here like “If I am too scared, size down“, Don’t get into illiquid stocks, don’t follow alerts from gurus, Cut Losses quickly, Singles win the game (regarding taking profits), Don’t add up to level down your position (Regarding adding size to a losing trade), If it doesn’t brake your risk have patience, don’t have FOMO, P.R.E.P.A.R.E (regarding Tim Sykes sss), Don’t try to catch a falling knife (regarding dip buying panic), Look for good Risk/Reward Setups, Don’t Chase, If buying into panic be quick to sell on the bounce, Trade the chart not your gains, When it is hard for a stock to break a level it is a sign of weakness, Focus on volatile stocks, It is easier to get into consolidation because you get to set your risk better, Surf the Momentum… and sooooo on.

What would have been a better way to make the trade?: This has helped me a lot, specially when things repeat a lot. In my case, Cutting Losses Quickly is the one that repeat the most and that is what I am focusing on right now.

Comments: Other things that I would like to add like “I was too nervous“ or “I was too impatient selling“ or “it got 60% higher than I sold“ “This thing can run“

% Profit Before Commissions:

% Profit After Commissions: I like to separate these two because of 2 things: First, I have 2 accounts (Fidelity and IB) and I like to know which one of them is better for commission optimization, for ex I have found that IB is better with high-price stocks, and Fidelity is better with really cheap stocks (regarding commission pricing , not executions). Also, on IB I can sell half of my position first to be more confortable and it is almost the same if I sell my whole position, on Fidelity they charge you for each time an order is executed regardless the number of shares. Second, about sizing: I have found that trading few shares of cheap stocks with little volatility is not a good idea. Commissions will end up eating you profits. Do this with different sizes and you will understand what I am talking about. Anyway, commission won’t matter if you focus on a really good setup and make a really good trade, plus, starting with small sizes makes you get better really fast. Faster than with paper trading. It will be not about the money but adding to your knowledge account as Tim Sykes says. This is more valuable than the money you will make on this small size trades.

I also add the chart to each trade to remind myself the key points of that trade. I show this on profit.ly like this: https://profit.ly/1Mtxm2

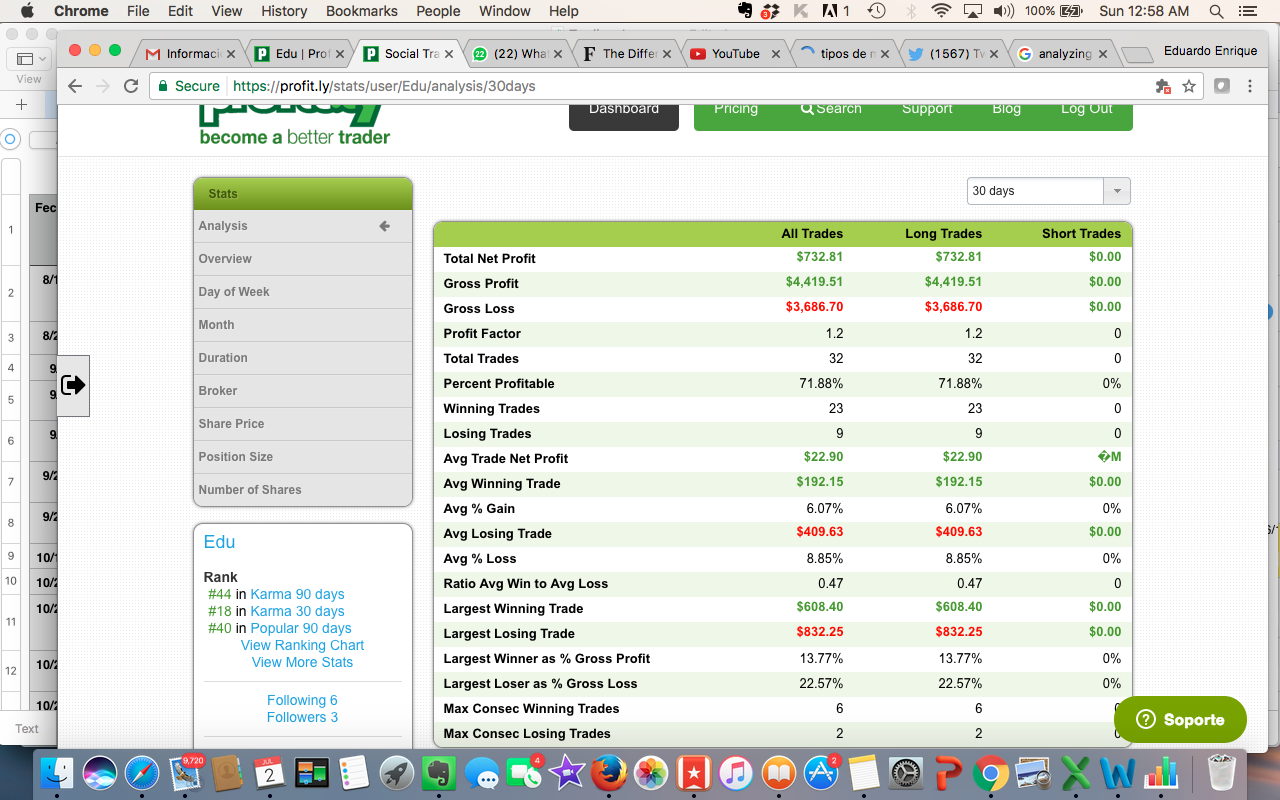

Once this is made, statistics pop out. I have found the following statistics really useful:

Winning ratio:

% profit average per winning trade:

% loss average per losing trade:

Average size per trade

Once you do this, you get to know what you really must focus on. Patterns of mistakes that you make, that if you correct them, your trading will get better.

I will share with you what I found after analyzing my trades and statistics and I will be applying this from July 2017:

1- Cut Losses Quickly: I have found that 54% of my monetary losses, comes from 20% of my trades. I have a great Winning Ratio (65%), but when I loss, I loss big. Also I have found that 77% of the times that I have won, my risk have not been broken, and those are the 84% of my winning money. What that tells me is that every time I hope for a comeback, I end up losing big, and the times that it has worked, It was not worth it. My % loss avg per trade is 9.09%. This means every time I lose, I end up losing over 9%… this is a looooot! And I am not counting the time that I have lost focusing on a miracle, that I could have spent studying, focusing on better trades, or working on other projects that I have.

2- Focus on good Risk/Reward trades using the odds: I use to love dip buying panics, because odds are that nearly every time, you will get a bounce. The tricky part is that you have to be really quick because too many people are going to short that bounce, and if you are not quick enough, you will end up losing big. This is a really bad risk/reward trade, but it happens a lot, so be aware of this: Aim really small (small reward) knowing that your risk is really high, and there are times where no bounce will come, and those are the ones that end up eating you last 9 small profits of former successful panic-buying trades. I do this a lot less now and I focus on better risk/reward trades, and now my %profit avg per winning trade has increased from 3.05% las month to 5.38% this month. This means that every time I win on a trade, (65% of the trades that I make), I make 5.38% on average.

3- Ride The momentum: I use to focus a lot on strong stocks that panics, not understanding that that was a sign of weakness. And when I got in the trade, I was against the trend. It is way easier if you just get into the trade with the same bias the trade is. This means in practical terms: After a big panic, be short bias right after bounces. If a stock holds its gains showing strength on support, be long bias. Obviously this is not a exact science, and things can get upside down, thats why Rule Number 1 exist: Cut Losses Quickly once your risk is broken.

4- Master the things that you are good at: I am not good at buying breakouts. I just think that I end up paying really high price on the stock and chasing its strength, I don’t know, it is just my personality. I learned that I am good at dip buying strong stocks and anticipating those intraday breakouts, for ex. earnings winner that holds it gains, or runners that shows strength after a period of consolidation. Knowing this, I will focus on those set ups, and once mastering it, I could test other strategies. But I will stick with what I am good at and master it. (This was a really valuable lesson from my “Why Entering the trade“ cell). A high percentage of my winning trades are dip buys, and a considerable percentage of my losing trades are buying breakouts.

5- Don’t have FOMO: I must let the trade come to me. This is crucial since the entry is the most important part of the trade, and If starting in a bad position, your risk will be broken way before you let your set up develop.

6- Singles win the game: I am really good at this. So good, that I underestimate a lot of winning trades that I am in. I will be a little bit more patient on this and wait for the stock starts to bleed. I always sell into strength, and very few times I get from green to red. Also I tend to sell half of my position on the way up. So I will test being a little bit more patient and aim for higher rewards (will aim por 10-20% gains).

I really encourage you guys to do this. I learned this from all the guys from T. Sykes`s team and customized it.

Hope it makes you a better trader. I know I am getting better and my statistics are showing that.

@edu_trades

@kilaci912 We must see what we are good at and master it

@pamelavfernan it is... it has a lot of decimals though...

Today, scientists unveiled the mathematical formula for perfect toast, revealing that it should be cooked for exactly 216 seconds. https://topaussiereviews.com/assignmenthelp4me-com-review/ A study by a group of researchers discovered that the ideal thickness is 14mm and the ideal amount of butter is 0.44 grammes per square inch.

Thank you for sharing this trend. Recently, I have been especially following web design trends, because this is necessary for my projects. I It is important that everything was chosen as carefully as possible, even the fonts and background. Recently I found an interesting source for this https://masterbundles.com/ I can find fonts, background and images that perfectly complemented my project.

Join now or log in to leave a comment